In the genesis of Bitcoin, Satoshi Nakamoto encoded a fundamental principle into the Bitcoin system: a fixed limit of 21 million bitcoins.

Total circulation will be 21,000,000 coins. It’ll be distributed to network nodes when they make blocks, with the amount cut in half every 4 years. first 4 years: 10,500,000 coins next 4 years: 5,250,000 coins next 4 years: 2,625,000 coins next 4 years: 1,312,500 coins etc…

Satoshi Nakamoto

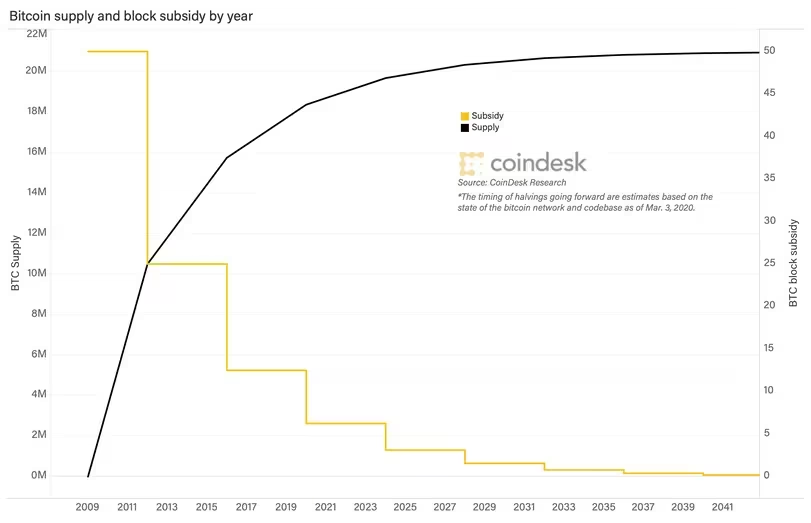

Since its inception, Bitcoin has seen a steady influx of new coins being minted. The total circulating supply continues to grow however, this growth is finite, destined to culminate at the predetermined cap of 21 million bitcoins.

As of now, the Bitcoin ecosystem boasts just over 19 million coins minted, with more being added every ten minutes according to a predefined issuance schedule. This cycle persists until the supply nears the 21 million mark, the ultimate limit of Bitcoin’s existence.

But how does this bitcoin issuance process unfold?

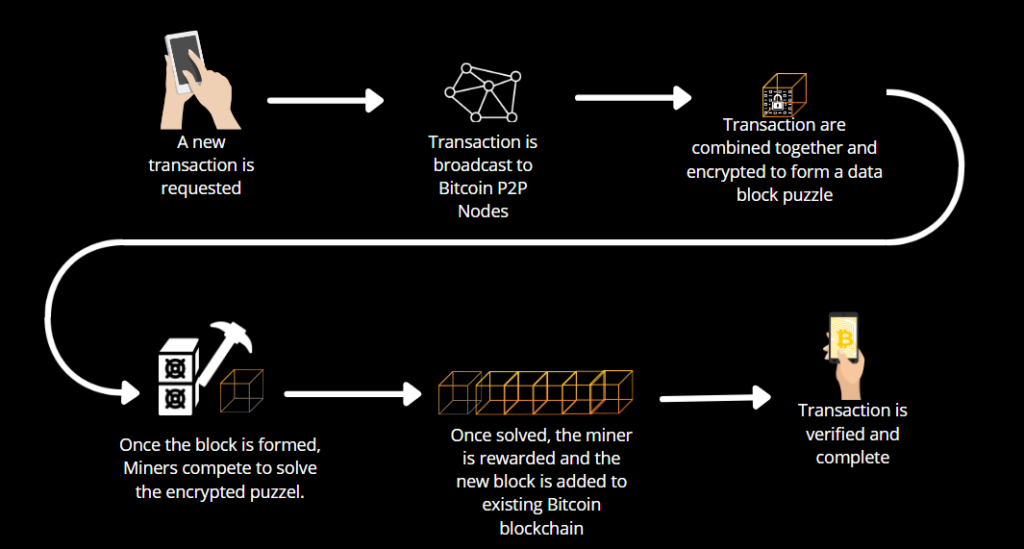

New Bitcoins emerge through the intricate mechanism of adding transactions to the blockchain. As transactions are added to Bitcoin’s global network of miners and nodes, they undergo scrutiny to ensure adherence to Bitcoin’s established codified rules.

Consensus is an emergent artifact of the asynchronous collaboration of thousands of nodes all following this simple process for every transaction broadcast to the network.

1) independent verification of each transaction by every full node on the network.

2) independent aggregation of those transactions into new blocks by mining nodes through proof of work algorithm.3) independent verification of new blocks by every node and assembly into a chain.

4) Independent selection by every node of the chain with the most cumulative computation demonstrated through proof of work.

Valid transactions are aggregated into blocks, initiating a competition among miners to append these blocks to the blockchain through the proof-of-work contest using specialized computers called ASIC miners.

Winning miners secure the right to add a new block to the chain, reaping rewards in the form of transaction fees and the coveted block subsidy otherwise known as freshly minted Bitcoins.

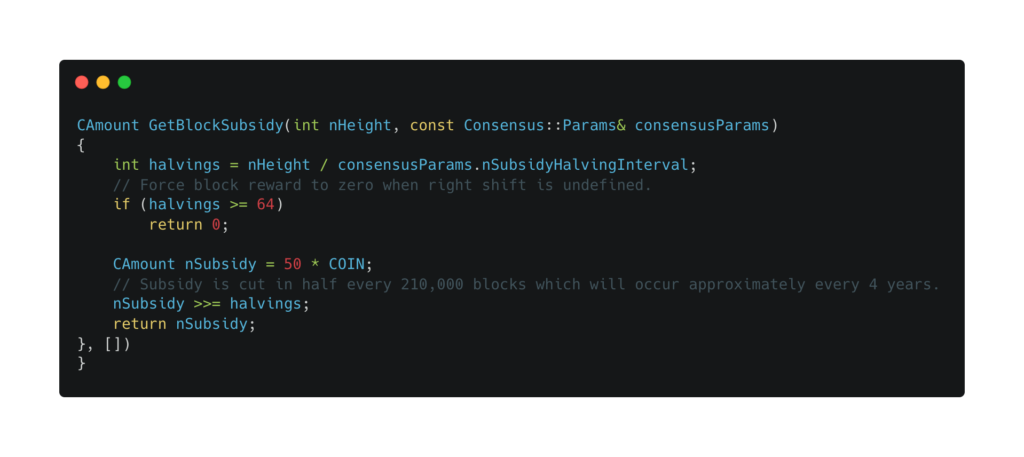

The block subsidy, conveyed through coinbase transactions, serves as the sole mechanism for introducing new Bitcoins.

Initially set at 50 Bitcoins per block for the first four years of Bitcoin’s existence, this subsidy undergoes halving every 210,000 blocks, eventually dwindling to zero.

At this juncture, miners rely solely on transaction fees for compensation.

Satoshi Nakamoto himself foretold this scenario on the BitcoinTalk forum in 2010, underscoring the transition from block subsidies to transaction fees as the primary incentive for miners.

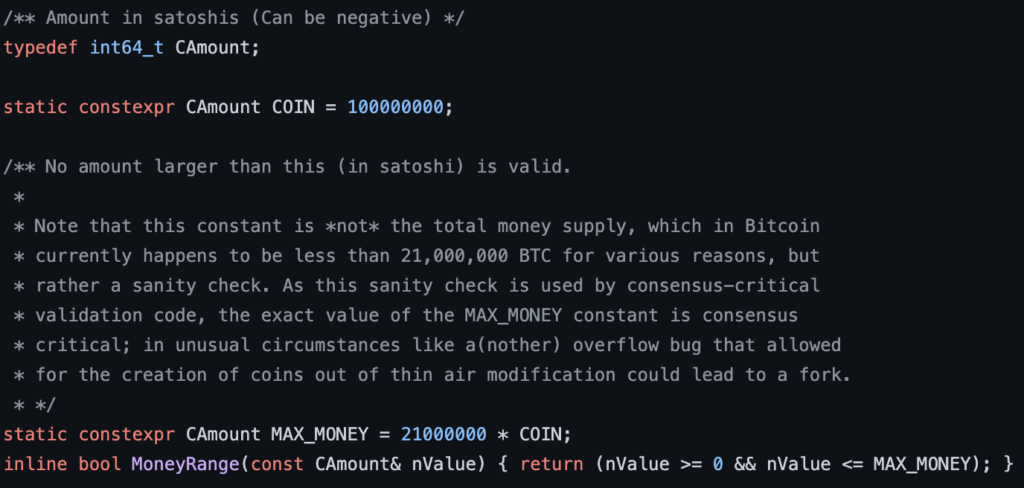

The mechanism behind Bitcoin’s fixed supply is embedded in its code, which meticulously delineates the issuance schedule and subsidy halving. Here is how the code looks for the halving.

Halvings, a key component of Bitcoin’s design, ensure a gradual and predictable distribution of coins until the 21 million limit is reached.

Yet, the integrity of Bitcoin’s fixed supply extends beyond its code.

Full node verification, conducted by participants in the Bitcoin network, upholds the consensus rules—including the 21 million coin cap—ensuring the validity of transactions.

Market dynamics also play a crucial role, with user consensus and rational self-interest reinforcing Bitcoin’s scarcity and the commitment to its immutable supply.

Parker Lewis eloquently articulates the significance of Bitcoin’s scarcity in his essay, Bitcoin Obsoletes All Other Money.

This quote sums it up nicely.

Recognize that there is nothing about a blockchain that guarantees a fixed supply, and bitcoin’s supply schedule is not credible because software dictates it be so.

Instead, 21 million is only credible because it is governed on a decentralized basis and by an ever increasing number of network participants.

21 million becomes a more credibly fixed number as more individuals participate in consensus, and it ultimately becomes a more reliable constant as each individual controls a smaller and smaller share of the network over time.

As adoption increases, security and utility work in lock-step.

Parker Lewis

Check out Parker Lewis’ Gradually, Then Suddenly series to go down the bitcoin scarcity rabbit hole.

As the Bitcoin network expands and grows, so does its security and credibility, solidifying the 21 million coin cap as a cornerstone of Bitcoin’s value proposition and the reason why so many people believe the price of 1 bitcoin relative to the USD is going to go up forever.

Bitcoin’s immutable supply of 21 million coins is not merely a product of code but a testament to the decentralized consensus and collective commitment of its users—a digital gold standard for the digital age.